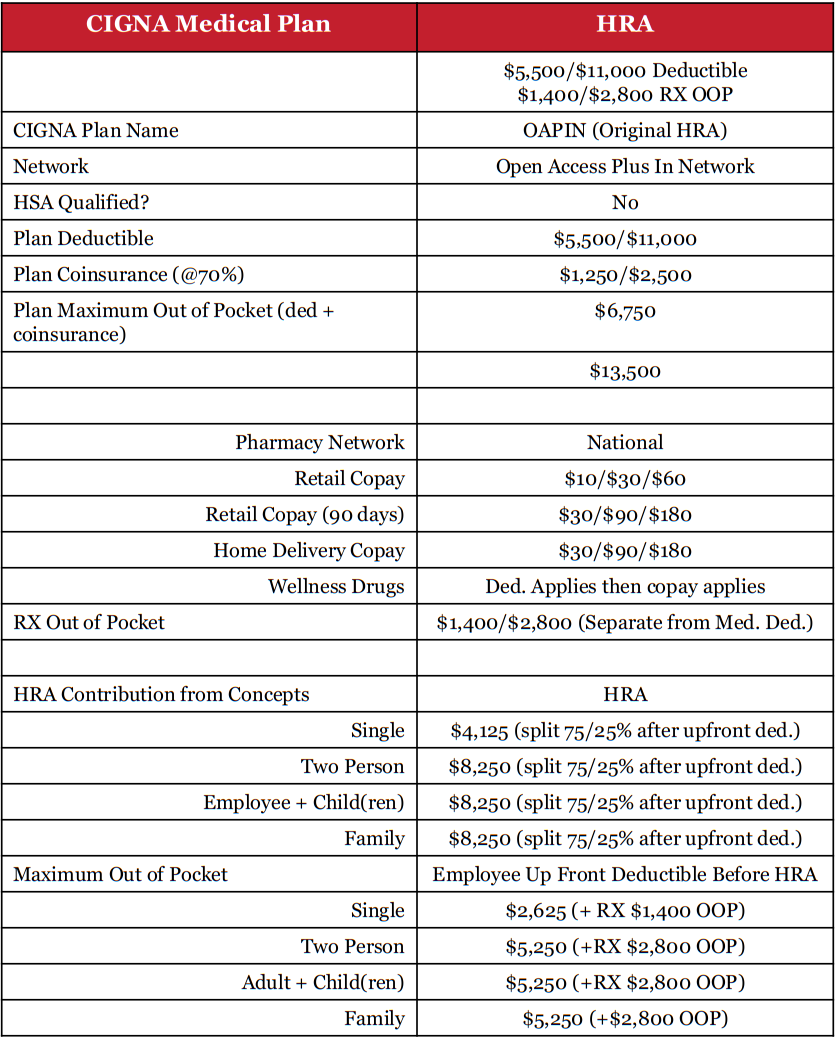

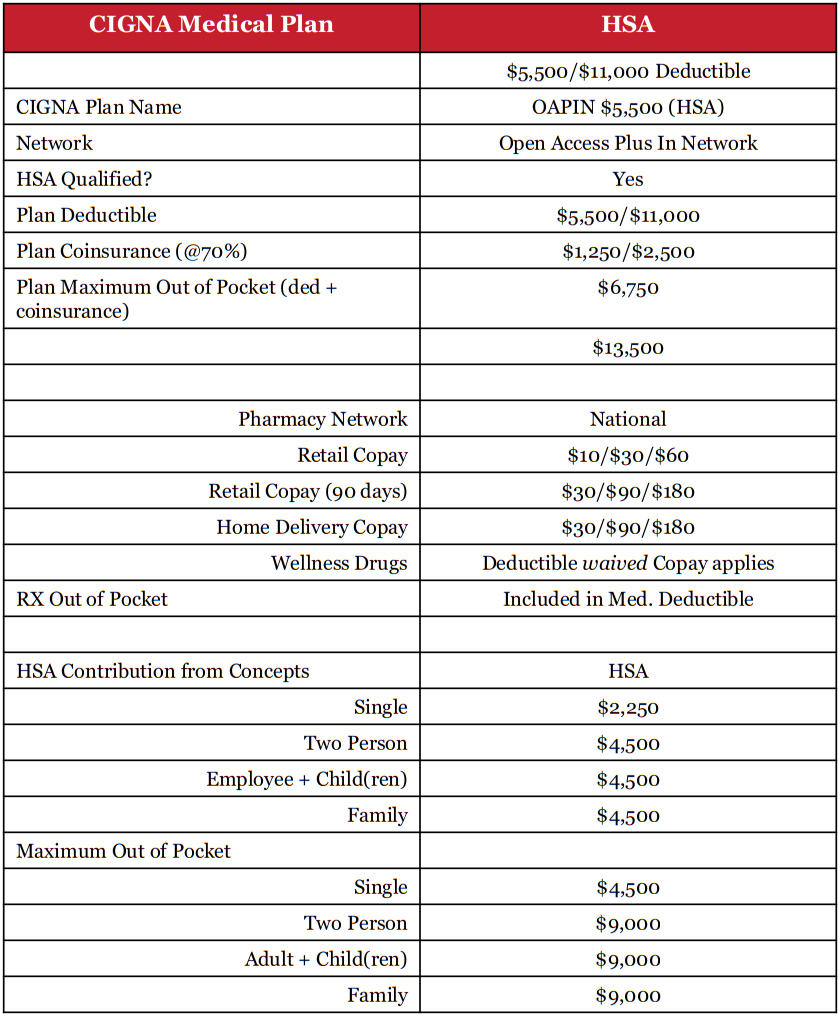

Your Medical Benefits

Pharmacy Information

MyCigna.com Resources

Discount Programs for Weight Loss

Forms and Plan Documents

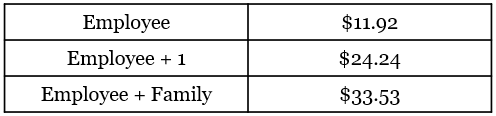

Your HRA & HSA Benefits

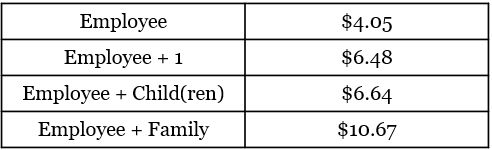

CN Holdings Contributes:

Health Savings Account

- You must be enrolled in a qualified High Deductible Health Plan (HSA Plan)

- For 2025 CN Holdings will contribute to your HSA

- $2,250 for single coverage

- $4,500 Employee/Spouse or Employee/Child(ren) plan, and the Family plan

- Health Savings – pre-tax dollars to use for health care

- You can deposit pre-tax dollars via payroll or

- You can deposit post-tax dollars and deduct expenses at year-end

- Or rollover an existing health savings account

- Only eligible expenses can be used with health savings

- Fund dental, vision, hearing, medical deductible or just save!

- Your HSA is owned by you, the money is yours even if you leave CN Holdings

- Elect HSA contributions to come directly from your paycheck through bswift

- Under age 55 and not enrolled in Medicare (based on a 12- month period):

- Up to $4,300 individual coverage

- Up to $8,550 family coverage

- Age 55 or older and not enrolled in Medicare:

- Maximum contribution increases by $1,000 (considered a “catch-up” contribution)

- Up to $5,150 individual coverage

- Up to $9,300 family coverage

- Employees may contribute pre-tax dollars to their HSA at any time during the year, not just during Open enrollment

- NOTE: Employees who enroll in the HDHP (high deductible health plan) & also elect to contribute to a Health Savings Account (HSA) may still elect a medical FSA, but will only be able to use funds for dental & vision expenses. This is an IRS Rule. This type of FSA is called a Limited Purpose FSA.

Eligibility

All employees who work a minimum of 24 hours per week are eligible for coverage on the 1st day of the month following date of hire.

Your FSA & DCA Benefits

An FSA is an annual election whereby an employee can elect to make pre-tax contributions to:

- General Medical Reimbursement Account*

- You may use your contributions to pay for unreimbursed/uncovered medical, dental and vision expenses.

- Maximum contribution amount is $3,300

- $660 can carry over into the next plan year

- Dependent Care Account

- You may use these contributions to pay for expenses associated with providing care to children under age 13

- You may elect up to a maximum of $5,000 depending on your tax filing status.

- Any unused dollars will be forfeited.

*Employees enrolled in the Modest plan are eligible for a Limited Purpose FSA which can only cover dental and vision expenses.

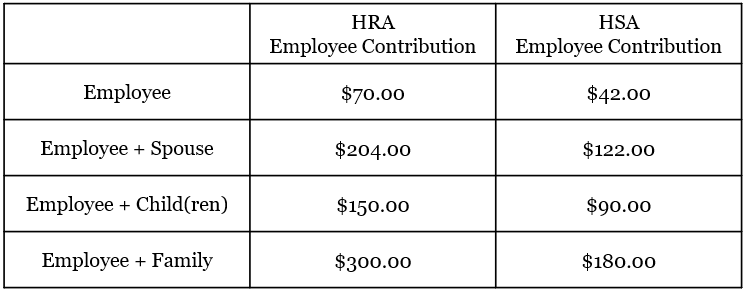

Contributions

Made By Employees.

Contact Information

Forms and Plan Documents

Your FSA/HSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

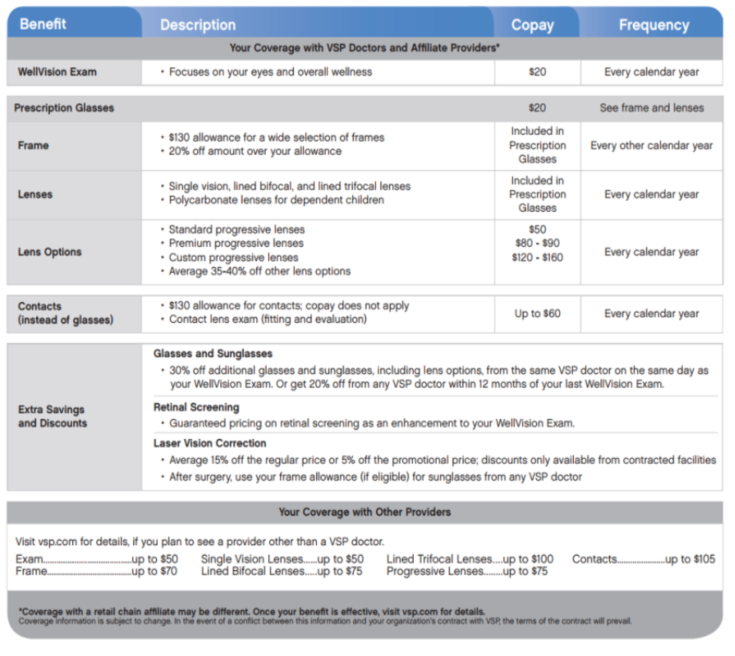

Your Vision Benefits

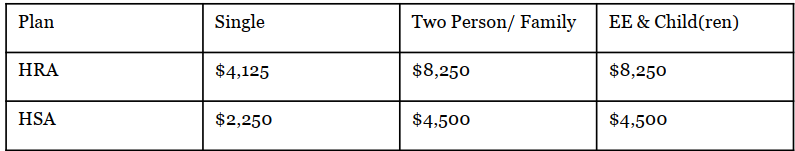

Your Dental Benefits

Employees are offered a comprehensive dental benefit insurance plan through Cigna Healthcare. Under this plan, insureds have the freedom to choose any licensed dentist for their preventative, basic, major and orthodontic dental care, but will only experience full reimbursement by using Cigna network providers

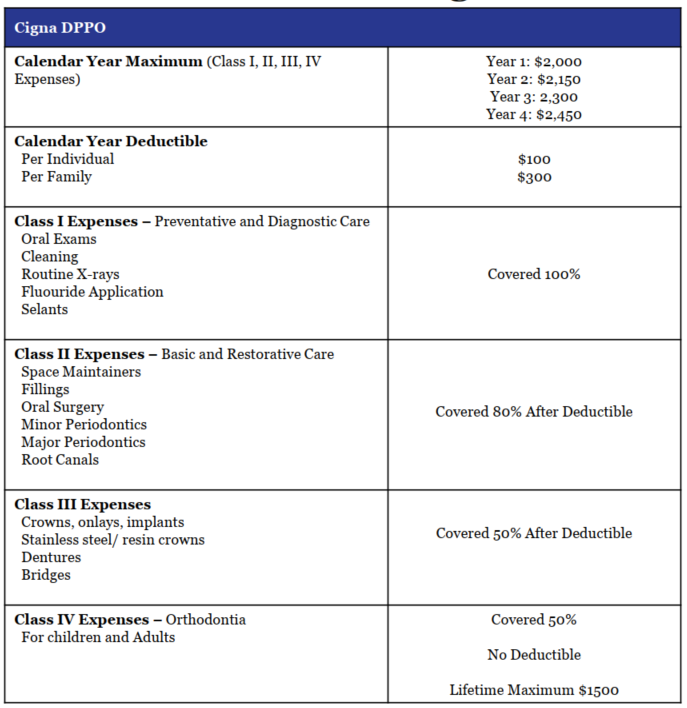

Contributions

Eligibility

All employees who work a minimum of 24 hours per week are eligible for coverage on the 1st day of the month following date of hire.

Your Life/AD&D Benefits

CN Holdings provides Basic Life & Accidental Death & Dismemberment (AD&D) Insurance to all eligible employees equal to Your Annual Salary, up to $250,000.

Eligible employees may purchase Voluntary Life and Accidental Death and Dismemberment (AD&D) coverage on themselves and their eligible dependents.

Contributions

Basic Life/AD&D premiums are paid for by the employer.

Voluntary Life Premiums are paid for by the employee.

Eligibility

All employees who work a minimum of 20 hours per week are eligible for coverage on their date of hire.

Contact Information

Your Disability Benefits

CN Holdings offers employees Short Term Disability coverage through Mutual of Omaha. This plan is designed to provide a continuation of benefits to you in the event of either sickness or accident.

- Employees may receive benefits starting on the 14th day of an accident or continuous illness and ending at 24 weeks, after which long-term disability may apply

- $100 Paid by Mutual of Omaha

- Remainder picked up by CN Holdings at 60% of weekly earnings

- Not to exceed 100% of weekly earnings including vacation and sick time

CN Holdings offers employees Long Term Disability coverage through Mutual of Omaha. This plan is designed to provide a continuation of benefits to you in the event of a disability.

- Employees may receive benefits starting after 26 weeks or your Short-Term Disability has expired

- Benefit is 66-2/3% of monthly pre-disability earnings, up to maximum $10,000, less deductible sources of income

- Benefit duration is up to your normal retirement age under the Social Security Act. If you become disabled at or after 65, benefits are payable according to an age-based schedule.

Contributions

Short Term Disability and Long Term Disability premiums are paid for by the employer.

Eligibility

All employees who work a minimum of 20 hours per week are eligible for coverage on their date of hire.

Contact Information

Forms and Plan Documents

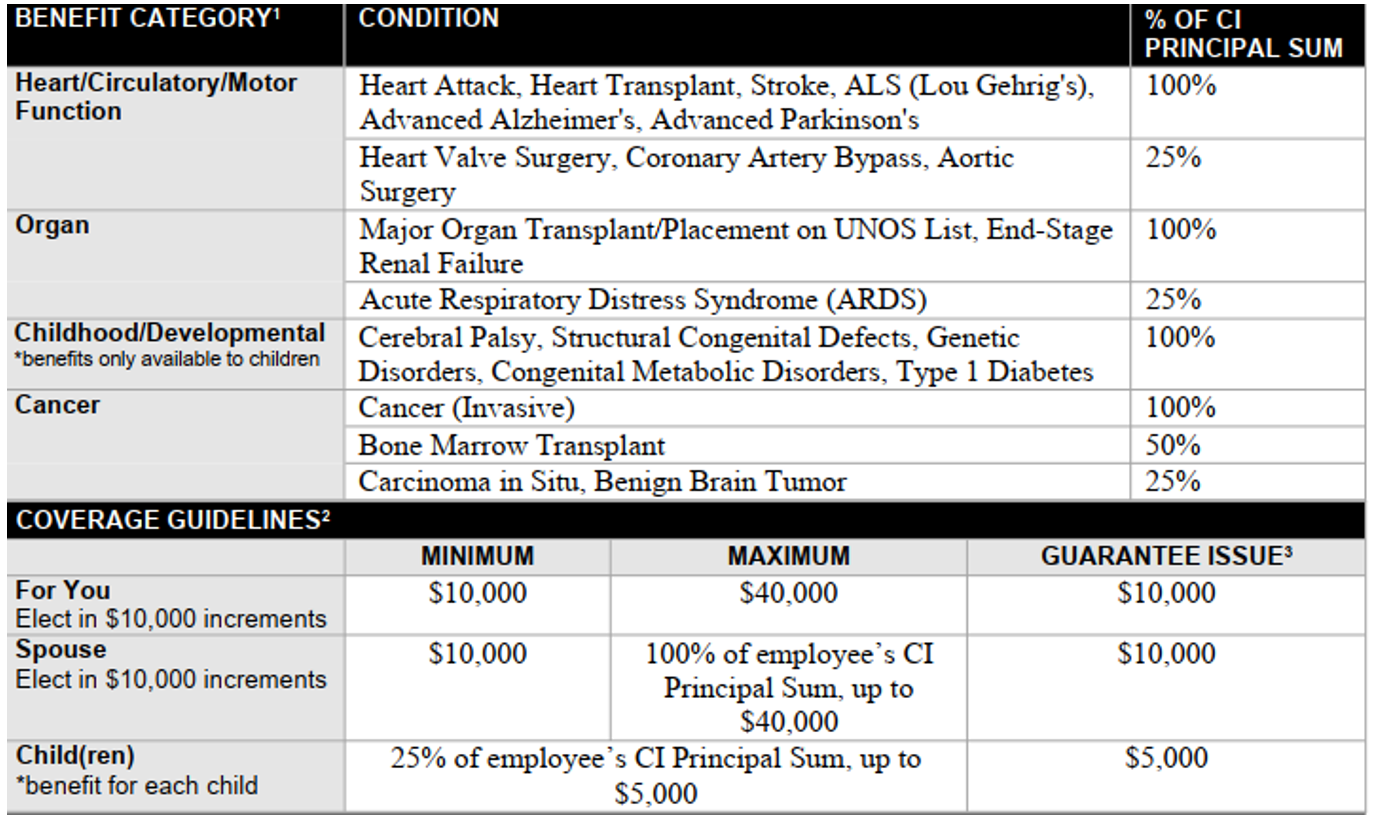

Your Critical Illness Benefits

CN Holdings offers employees Critical Illness Coverage through Mutual of Omaha. This plan is a lump-sum benefit payable for an insured person diagnosed with certain critical illnesses while insurance is in effect for the insured person, after any applicable waiting period and subject to any pre-existing condition limitation.

Contributions

Critical Illness premiums are paid for by the employee and based on the coverage amount chosen.

Eligibility

All employees who work a minimum of 20 hours per week are eligible for coverage on their date of hire.

Contact Information

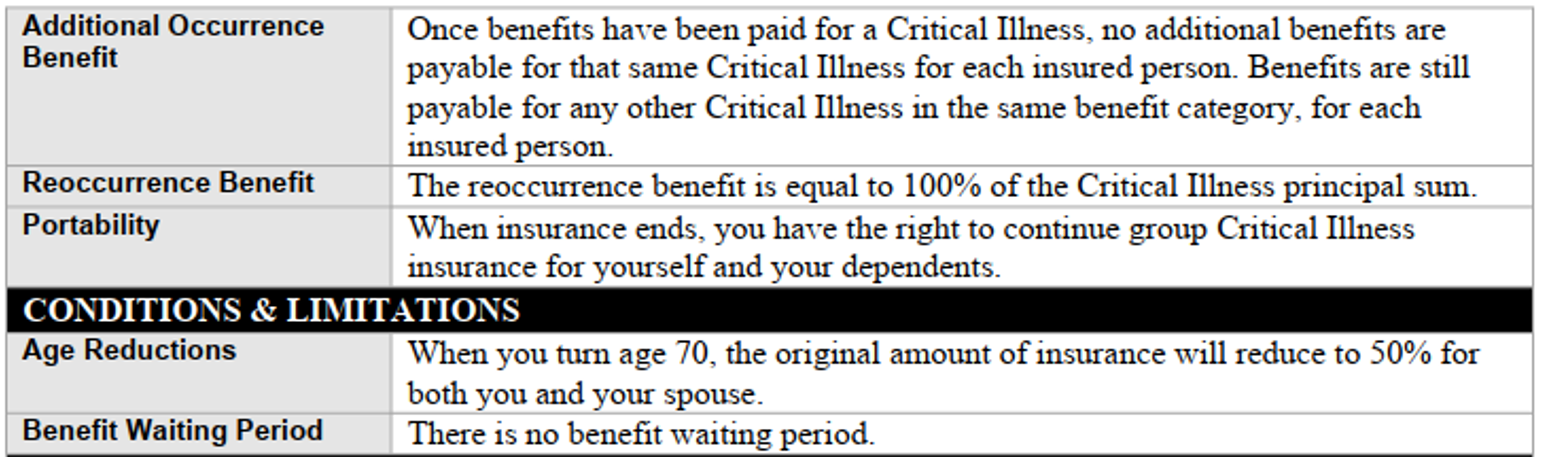

Your Accident Benefits

CN Holdings offers employees Accident Insurance coverage through Mutual of Omaha. Accident insurance pays a lump-sum cash benefit for covered injuries employees or an insured family member sustains as a result of an accident (as defined by the policy). Because accident insurance is supplemental, it works in addition to other insurance employees may have.

The cash benefit from accident insurance can be used to:

- Pay for out-of-pocket medical expenses

- Supplement daily living expenses

- Cover lost income from unpaid time off

Example of Coverages:

INITIAL CARE &

EMERGENCY BENEFITS

Most Initial Care/Emergency benefits require treatment or service within 72 hours of an accident and are payable once per accident per insured person.

Contributions

Short Term Disability and Long Term Disability premiums are paid by the Employee based on the amount of Coverage chosen.

Eligibility

All employees who work a minimum of 20 hours per week are eligible for coverage on their date of hire.

Contact Information

Your Pet Insurance Benefits

Health Coverage For Your Furriest Family Members

- Coverage for Cats and Dogs of All Ages and Breeds

- No Initial Exam/Past Vet Notes Required

- Accident Coverage Starts at Midnight

- Customizable and Out-of-Pocket Max

- Annual Max Payouts as Opposed to Per Incident

- Choose Your Reimbursement Percentage

- Multiple Value-Added Benefits Included

- Routine Care Option Available with Customized Plans

- Available in all 50 States!

How does Pet Insurance Work?

Your 401(k) Benefits

Employees can enter the plan on the first day of the calendar month following date of hire or the date employee attains age 21.

Employees may contribute pre-tax up to the IRS Federal Maximum. The maximum in 2025 is $23,500. If you are age fifty or older by the end of the calendar year, you may be able to contribute an additional $7,500 of your compensation.

Your EAP & Will Prep Benefits

The Employee Assistance Program benefit with Will Preparation at no cost to the employee. When you call, you will speak directly to an EAP professional to receive immediate support and guidance. If additional resources are needed, your EAP professional can assist by locating affordable solutions in your area. This benefit assists employees and their eligible dependents with personal and job-related concerns, including emotional well-being, family and relationships, legal and financial, healthy lifestyles, work and life transitions.

Contributions

Premiums are paid for by the employer

Eligibility

All employees who work a minimum of 20 hours per week, and their family members, are eligible for coverage on their date of hire.

Contact Information

Your Travel Assistance with Identity Theft Benefits

Travel Assistance is available to employees and their dependents who are traveling 100 or more miles from home. Benefits include pre-trip assistance, immediate assistance with emergencies while traveling, medical assistance, and provides emergency travel support services. Identity Theft Protection can help protect, educate, prevent, and recover information.

Contributions

Premiums are paid for by the employer

Eligibility

All employees who work a minimum of thirty (30) hours per week are eligible for coverage on the 1st day of the month following 30 days of continuous employment. Employee must participate in the basic life to receive this benefit.

Contact Information

Your Tuition Reimbursement Benefits

The CN Holdings tuition assistance program is designed to help CN Holdings employees pay back student loan debt and improve their financial well-being.

Utilizing CN Holdings’ relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Your MemberDeals Benefits

The Richards Group employees have now access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels and much more.

- Save up to 40% on Top Theme Parks Nationwide

- Save up to 60% on Hotels Worldwide

- Save up to 40% on Top Las Vegas & Broadway Show Tickets

- Huge Savings on Disney & Universal Studios Tickets

- Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more!

Your Wellness Outlet Benefits

The Richards Group offers employees discounts through the Wellness Outlet!

Enter account code RICHARDSGRP at The Wellness Outlet for access to discounts of 18-40% off retail price of fitness trackers from Fitbit and Garmin, plus free shipping to your home.

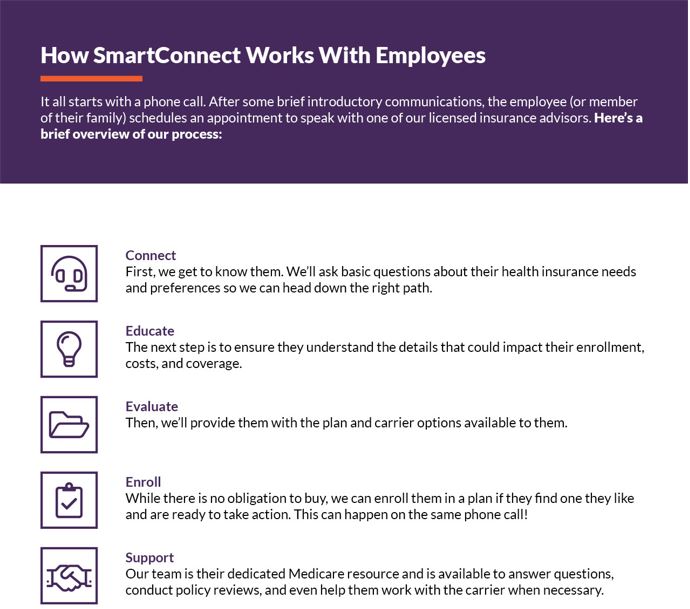

Your SmartConnect Benefits

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

Phone: 1-833-502-2747 TTY 711

For more information or to get started, please click on the following link:

Additional Information